In recent years, the most significant shifts in the Japanese handbag market have centered on the rapid rise of vegan leather, recycled materials, and lightweight construction. These three trends are now defining consumer expectations and will play a crucial role in shaping brand competitiveness from 2025 to 2029.

The shift toward vegan leather, recycled materials, and lightweight construction is accelerating in Japan.

This trend is driven by:

-

Stronger environmental awareness and a preference for low-impact materials

-

High spending power, paired with stricter expectations for durability and weight

-

Growing demand for lightweight designs among commuters and younger consumers

-

Intensified competition between global and Japanese brands in sustainable innovation

As these preferences become mainstream, understanding Japan’s handbag market trends and forecasts for 2025–2029 is essential. These insights help brands and manufacturers:

-

Identify new product opportunities

-

Choose suitable materials

-

Plan supply chains more effectively

-

Enter or expand in the Japanese market with confidence

What Is the Current State of Japan’s Handbag Market?

Market Size & Growth

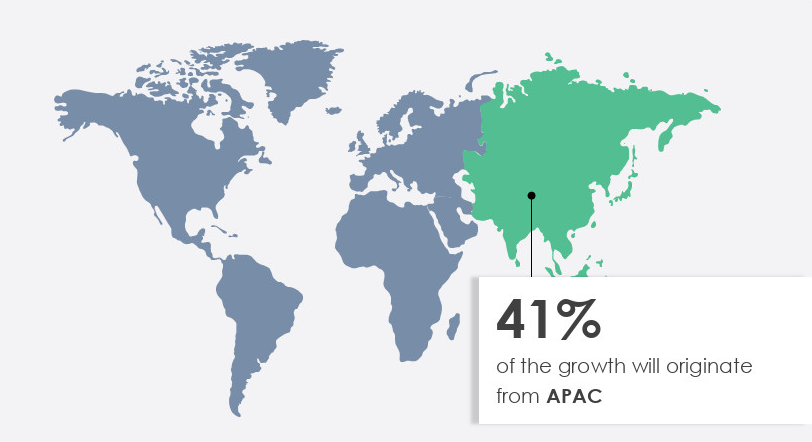

Japan remains one of the most stable and high-value handbag markets in Asia. The market continues to grow steadily, with an estimated market size of USD 3.5 billion in 2024 and a projected CAGR of 4% through 2029. Demand is strongest for categories emphasizing quality, durability, and refined aesthetics, with black handbags remaining a perennial favorite due to their versatility and timeless style. This trend reflects Japan’s long-standing consumer values and preference for practical yet stylish designs.

Key Product Categories

The Japanese handbag market is diversified, with several categories showing strong performance:

-

Leather handbags

-

Tote bags

-

Business bags & functional daily bags

-

Lightweight nylon or canvas bags

-

Small leather goods (wallets & card holders)

Among these, lightweight functional bags and premium leather styles continue to dominate due to Japan’s practical yet quality-conscious consumer base.

Consumer Purchasing Behavior

Japanese buyers demonstrate clear and consistent shopping patterns:

-

Online vs. Offline

-

Omni-channel purchasing is strong, with online growth accelerating in recent years.

-

Offline retail remains influential due to Japan’s culture of in-store product experience and trust in established department stores.

-

-

Brand Preferences

-

Consumers value craftsmanship, material quality, and brand heritage.

-

International luxury brands perform well, while Japanese domestic brands attract loyal repeat customers through durability and design simplicity.

-

Market Drivers

Japan’s handbag demand is shaped by a combination of cultural habits, consumer expectations, and evolving lifestyle trends. From a personal perspective, it’s fascinating to see how Japanese shoppers balance a love for timeless craftsmanship with an increasing interest in eco-friendly, practical designs—a dual focus that drives both traditional leather goods and newer lightweight, sustainable bags.

-

Fashion culture rooted in minimalism and craftsmanship

-

High expectations for product quality and longevity

-

Strong gifting culture, supporting stable demand across seasons

-

Growing sustainability awareness, boosting interest in vegan leather and recycled materials

-

Lifestyle shifts, including commuting needs and the popularity of lightweight daily-use bags

From our perspective as a handbag manufacturer, Japan’s market is steadily growing, with consumers favoring classic black handbags, lightweight designs, and eco-friendly materials, creating a strong demand for high-quality, versatile, and sustainable products.

How Is Japan’s Handbag Market Evolving from 2025 to 2029?

Building on the previous analysis of Japan’s handbag market—where classic black handbags, lightweight designs, and eco-friendly materials are driving growth—we will focus on several key trends shaping the industry from 2025 to 2029:

Sustainability and Rising Demand for Vegan Leather

Japanese consumers are increasingly seeking handbags made from vegan leather, recycled materials, and other low-impact fabrics. This shift reflects growing environmental awareness and a preference for responsible, long-lasting products. Manufacturers with strong sustainability practices, like Sunteam, can meet this demand through eco-friendly materials and innovative production processes.

Lightweight and Functional Designs

Functionality and portability are becoming essential. Bags that are lightweight, multi-purpose, and easy to carry appeal especially to commuters and younger consumers. Japan’s preference for minimalist, high-quality, and durable designs reinforces the popularity of versatile everyday bags. Sunteam’s flexible OEM/ODM production and small-batch handbag customization allow brands to quickly develop such functional designs.

E-Commerce Growth

Online sales continue to expand, driven by convenience and broader product selection. Brands must adapt to multi-channel strategies to reach tech-savvy consumers. Sunteam can support this with efficient production planning and reliable delivery to align with online retail demands.

Competitive Landscape: Domestic vs. International Brands

Competition between Japanese and global handbag brands is intensifying, pushing innovation in materials, design, and sustainability. Manufacturers that can offer consistent quality, design flexibility, and customization of handbag options are better positioned to capture market share.

Supply Chain and Logistics Stability

As consumer expectations rise, stable supply chains and reliable logistics are critical. Sunteam’s experienced manufacturing teams and controlled material sourcing help ensure consistent product quality, timely delivery, and the ability to respond to market fluctuations.

Which Handbag Materials Are Driving Growth in Japan?

Japan’s handbag market is diverse in terms of materials, with each category reflecting different consumer preferences, price ranges, and market shares:

1. Genuine Leather

-

Market Share: Approximately 45% of total handbag sales

-

Price Range: USD 200 – 800 per bag

-

Consumer Preference: Japanese buyers highly value craftsmanship, durability, and premium feel. Genuine leather bags remain the most popular choice for formal and luxury purchases, including classic black handbags.

2. Vegan Leather

-

Market Share: Around 15–20%, growing rapidly

-

Price Range: USD 100 – 400

-

Consumer Preference: Driven by environmental awareness and ethical consumption, vegan leather appeals to younger consumers and urban professionals seeking stylish yet responsible alternatives.

3. Canvas

-

Market Share: Roughly 15%

-

Price Range: USD 50 – 250

-

Consumer Preference: Lightweight, casual, and durable; popular for daily commute, travel, and student use. Customizable prints and seasonal designs are also attractive.

4. Nylon

-

Market Share: About 10%

-

Price Range: USD 70 – 200

-

Consumer Preference: Functional and easy to maintain, nylon bags are favored for sports bags, travel bags, and multifunctional designs, often appreciated for their lightweight and water-resistant hangbag properties.

5. Recycled Materials

-

Market Share: Around 5–10%, with strong growth potential

-

Price Range: USD 80 – 300

-

Consumer Preference: Increasingly recognized by eco-conscious consumers, recycled material bags combine sustainability with practicality and appeal to brands seeking to highlight environmental responsibility.

Conclusion

In summary, Japan’s handbag market remains one of the most stable and high-value markets in Asia, driven by a combination of classic style preferences, high-quality expectations, and growing sustainability awareness. Consumers increasingly favor lightweight, durable, and eco-friendly materials, with black handbags continuing to dominate in both genuine and vegan leather segments.

For handbag manufacturers and brands, this presents a clear opportunity to meet diverse consumer demands through flexible OEM/ODM bag production, small-batch customization, and innovative material solutions. By aligning product development with Japan’s evolving preferences—combining timeless design, practicality, and sustainable materials—manufacturers like Sunteam can capture market share, satisfy discerning buyers, and stay ahead in a competitive landscape.