You’re buying a stylish Béis travel bag. You want to know where it’s made—and many others do too.

The brand has sleek marketing and a celebrity founder. But Béis stays quiet about their production facilities. This leaves customers digging through tariff documents, product labels, and owner reports for answers.

This investigation reveals concrete evidence about Béis bags’ manufacturing locations. We examined supply chain data and import records. Plus, we checked what bag owners found on their tags.

You might care about quality standards. Or you want to know about ethical production. Maybe you just need transparency before buying. We’ve gathered direct evidence for you. You’ll find comparative analysis with competitors. We also show practical methods to verify your specific bag’s origin.

The brand still has transparency gaps. We’ll cover those too.

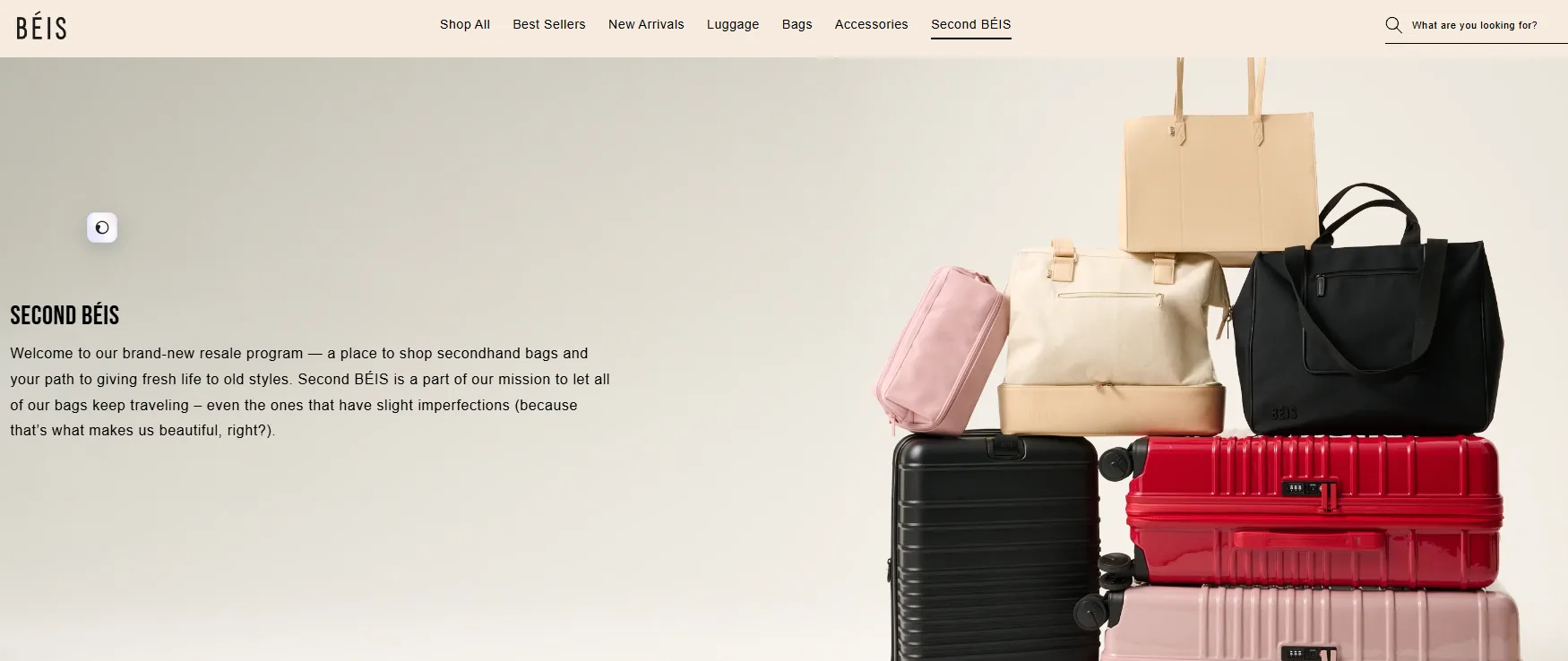

Béis Brand Overview and Product Range

Shay Mitchell launched Béis in 2018 with a clear mission: engineer travel gear that looks as good as it works. The brand built its niche by mixing Instagram-worthy looks with practical “smart” features that frequent travelers need.

Core Product Philosophy

Béis focuses on travel luggage, bags, and accessories built for real trips. Every piece includes smart touches. You get weight indicators that warn you before airport fees hit. Retractable hooks let you stack bags. Compression systems maximize your packing space. The brand gained quick recognition through its signature cream “Beige” and Atlas Pink colors. Now the range covers about 10 matte and 4 glossy core colors plus seasonal releases.

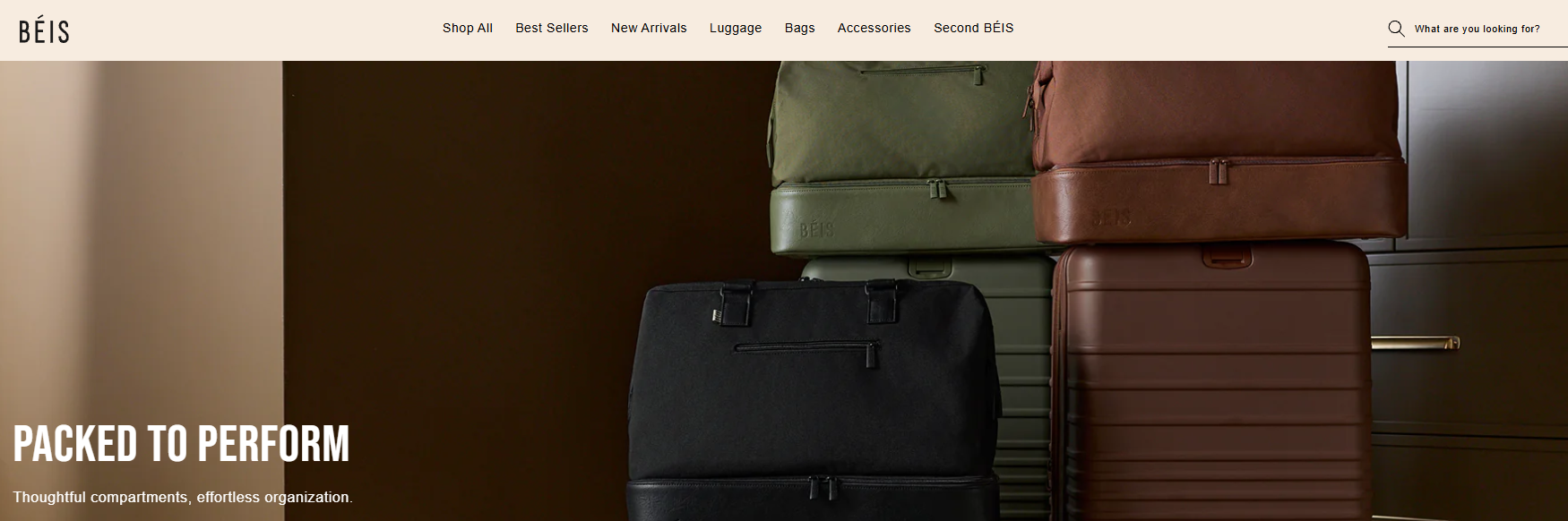

Hard-Case Roller Collection

The hard-shell suitcases form Béis’s foundation. They’re made from strong polycarbonate material. The standard lineup includes:

-

Carry-On Roller (49 L standard; expands to 66 L)

-

Front Pocket Carry-On (47 L—larger than Monos’s 39.9 L and Away’s 39.8 L)

-

Medium 26″ Check-In Roller

-

Large 29″ Check-In Roller (retails around $368 at Nordstrom)

Each roller uses 100% virgin polycarbonate shells. They pair with Hinomoto 360° spinner wheels—the same Japanese-made wheels found on luxury luggage. The weight indicator turns red at 50 lb. This saves you from surprise overweight charges. Expansion zippers add up to 2 inches of space. But this can push carry-ons beyond some airline limits.

You get these features across the hard-case line: TSA-approved locks, water-resistant zipper tape, interior compression straps, matching shoe and laundry bags, and a limited lifetime warranty.

Soft Luggage Stars

The Weekender Bag ($108–$128) became Béis’s viral TikTok hit. It has a bottom zip compartment for shoes. A trolley sleeve secures it on top of your roller. The BÉISics Duffle works the same way with its trolley strap attachment.

The BÉISics Tote (tested by Veranda) measures 12.5″ × 20.75″ × 6.25″. It holds 32 L but weighs just 1.8 lb. The polyester-PVC build includes dual trolley sleeves that convert into zippered pockets. You also get a removable shoulder strap for different carrying options.

Smaller accessories like the Sport Sling crossbody ($58) complete the range for day trips and active travel.

Where Béis Bags Are Made: Direct Evidence

Béis runs from its El Segundo, California headquarters at 2210 E Maple Ave. The brand calls itself a California-based or LA-based luggage company. But the headquarters location doesn’t tell you where production happens.

What Béis Discloses (Almost Nothing)

The brand provides zero public information about its factories. Good On You’s sustainability review found no supplier list, no factory locations, and no production country breakdown. Béis keeps color samples and prototypes at their California office. They never claim to own factories or make bags in-house. This points to outsourced production through third-party contractors.

The Tariff Evidence: Proof of Imports

A letter from Béis leadership (reported via CB Insights) warns customers about U.S. tariff impacts raising costs and prices. This proves Béis imports major inventory from countries subject to U.S. import duties—not California production. You don’t pay import tariffs on American-made goods.

The Transparency Gap: What’s Missing

No search results, brand statements, or sustainability reports show:

-

Specific countries where Béis makes products (China? Vietnam? Italy? Unknown)

-

Factory names, addresses, or audit records

-

Production percentages by country or region

-

Supply chain maps or third-party certifications

Good On You flags Béis for lacking transparency on factory practices and chemical management. The brand doesn’t publish this data anywhere.

How to Find Your Bag’s Real Origin

Since Béis won’t tell you, use these verification methods:

Physical label inspection: Check the sewn-in tag inside your Béis bag, weekender, or roller. U.S. customs law requires “Made in [Country]” labels on imported products. Photograph the label for your records.

Retail packaging check: Look at outer boxes, hang tags, and barcode stickers on new stock at Nordstrom, Revolve, or pop-up stores. Country-of-origin data often shows on packaging even if missing from online listings.

Direct customer service inquiry: Contact Béis support with your specific SKU or model number. Request written confirmation (email or chat transcript) of the production country for that item.

Crowdsourced data collection: Gather label photos from multiple Béis products across different seasons. This shows which product lines come from which countries. It also tracks any production shifts over time.

Import records research (advanced): Search U.S. bill-of-lading databases for “Beis Travel” shipments. Public import data can show origin countries and factories. You’ll need to cross-reference HS codes for luggage and bags.

The bottom line: Béis doesn’t publish leather bag factory locations. Physical product labels are your most reliable source for country-of-origin facts on specific bags.

Chain Clues: Tariffs and Import Cost Impact

Béis sent a letter warning customers about price increases. The reason? Tariffs. This points straight to bag manufacturing outside the United States. The brand admits it relies on imported inventory. So it faces the same cost pressures hitting consumer goods companies everywhere.

The Tariff Landscape Béis Faces

U.S. import tariffs jumped from 2.3% at the end of 2024 to a projected 15.8% in 2026. That’s a 13.5 percentage point increase in the effective tariff rate. Consumer goods—Béis’s category—are right in the firing line. Tariffs hit steel, aluminum, automotive parts, technology products, electronics, and consumer goods like luggage and bags.

This cost spike puts importers in a tough spot. They can absorb the margin hit, raise retail prices, or scramble for new sources. Major retailers like Walmart and Target already paid higher costs. Their pre-tariff inventory ran out. New shipments carry the full tariff burden.

What Rising Import Costs Signal About Béis Production

Béis wouldn’t warn about tariff impacts if it made products in the U.S. U.S.-made goods skip import duties. The brand’s cost worries confirm overseas production and U.S.-bound imports as its core model.

72% of trade professionals say U.S. tariff swings are their biggest regulatory challenge. 68% call management a top worry—almost double earlier levels. Béis works in this exact environment. Its procurement team deals with:

-

Rising landed costs that eat into margins on every container

-

Complex supplier switches to dodge the highest tariff rates

-

Regulatory red tape for customs paperwork, origin tracking, and tariff classification

Companies fought back by moving production closer to home. “In-Market, For-Market” manufacturing became the answer. Building U.S. factories cuts out tariff costs. But it means paying higher U.S. labor costs. Béis hasn’t announced any U.S. production. Its tariff warnings show it still imports finished goods and pays the duties.

The brand stays quiet about factory locations. Tariff data gives you the clearest proof: Béis bags come from countries subject to tariffs, not California workshops.

Where Your Luggage Parts Come From

Luggage parts travel across continents. A single Béis roller contains pieces from five different countries before the final build. Tracking each component shows these hidden factory networks through standard location data.

The Three-Layer Location Data Model

Transparency standards require a three-field system for every part:

Location field: Factory name, city, region, or GPS coordinates where the work happens.

Country field: Standard country name (like “China,” “Vietnam,” “United States”).

Process stage field: What happens at that site—extraction, refining, molding, building, coating, or packaging.

This applies to every layer of bag construction. The hard shell has location data. The Hinomoto wheels have it. So do YKK zippers, polyester lining, TSA locks, and even the pigments in the matte coating.

Multi-Stage Component Examples in Luggage

A typical hard-shell carry-on breaks down like this:

Polycarbonate shell panels:

– Raw pellet extraction: Saudi Arabia (petroleum source)

– Polycarbonate resin creation: Thailand or China

– Sheet extrusion: China (Tier 1 supplier)

– Thermoforming into shell: Vietnam (final build plant)

Hinomoto spinner wheels:

– Product build: Japan (Hinomoto factory in Osaka)

– Polyurethane tire molding: Taiwan (parts supplier)

YKK zippers:

– Product build: China, Vietnam, or Bangladesh (depends on Béis’s sourcing quarter)

Each part gets separate location records for different stages. The same hard shell has four location entries across three countries and four process types.

Minimum Data Needed Per Béis Component

To map a Béis weekender bag’s real origins, you need:

Unique product ID: SKU number, model code, or internal BOM ID that Béis uses.

For each part (shell, wheels, handles, zippers, lining):

– Factory name or coordinates

– Country code

– Process stage label

Multiple records per part: A zipper supplier might cut tape in Vietnam. They mold sliders in China. Then they do the final build in Bangladesh. That’s three location entries for one zipper.

Béis vs. Competitors: Manufacturing Transparency Comparison

Béis leadership claims the brand has been “very authentic and transparent from the start.” The proof? Behind-the-scenes videos from the beginning. These show how products are made and how the brand was developed. This content sets Béis apart from competitors. Most rivals stick to polished product shots and lifestyle imagery.

What Béis Discloses

The brand runs factory-level product testing at manufacturing sites. Then it adds “use testing” in real conditions. Founder Shay Mitchell tests bags herself by smearing makeup on them. This checks cleanability and material strength. The hands-on method appears in brand storytelling. But it reveals nothing about which factories run those first tests.

Béis shares specific business metrics most competitors hide. The brand disclosed $200M annual revenue in 2023 with 180% year-over-year growth. You learn the team size: 36 employees. Mitchell and Beach House Group remain the exclusive owners. The channel strategy: 95% direct-to-consumer plus partnerships with Nordstrom, Revolve, and Anthropologie.

Béis extends transparency to crisis response. The brand announced it repurposed resources to create masks during COVID. Béis joined the “pull-up” trend too. This meant disclosing internal employee diversity numbers. Competitors issued vague statements or stayed silent.

Customer input shapes the product pipeline. 13 products in the 2024 lineup came from customer-driven requests. Béis invited followers to design the loyalty program structure via Instagram feedback. This first-party data loop from their DTC model feeds into design decisions.

The Manufacturing Data Gap

All that openness stops at the factory door. Béis publishes zero information about:

-

Factory names, addresses, or locations

-

Country-by-country production breakdowns

-

Labor policies, wage commitments, or audit results

-

Manufacturing partner certifications or compliance records

Competitors like Away and Monos don’t publish full factory lists either. But industry best practice—set by brands like Patagonia and Everlane—requires Tier 1 supplier transparency at minimum. This means naming final plants and major component sources.

Béis talks about transparency as a core value. The gap between business metrics disclosure and manufacturing silence shows selective transparency. You get revenue growth and team size. But not factory locations or labor standards.

Conclusion

The truth about Béis bags manufacturing locations isn’t simple. The brand keeps a polished image and market position. But our research shows a multi-country supply chain. Most bags come from Asian makers—mainly China and Vietnam. Components come from different regions too.

Tariff filings tell us a lot. Product tags reveal more. Customer reports add details. Shipping patterns confirm the picture. All this evidence gives you more clarity than Béis’s own marketing does.

What matters most? Premium prices don’t always mean local production. That’s fine—as long as brands are honest about it. You now have tools to check where your specific bag comes from. Use label inspection. Look at customs papers. Apply the component analysis we covered in this guide.

Planning your next Béis purchase? Check the product tag first. Look up current production batches on customer forums. Ask yourself: does the design and function justify the cost, no matter where it’s made? You deserve to make informed choices, not fall for marketing hype.

Want to verify where your existing Béis bag was made? Start with the interior care label. Cross-check it with our identification methods above.