Vietnam has become one of the world’s top spots for leather bag manufacturing. Global brands come here for quality craftsmanship at competitive prices. You can scale production easily too.

Looking for your first bag production partner? Or maybe you’re an established brand exploring Southeast Asian options beyond China. The right manufacturer will make or break your product line.

Here’s the challenge. Vietnam’s leather industry is scattered. Small artisan workshops operate in Hoi An. Large-scale factories serve luxury European brands. Everything exists in between.

Each manufacturer has different strengths. Some work with exotic leathers and hold CITES certifications. Others focus on high-volume budget production. A select few bring premium Italian leather skills that luxury brands need.

This list covers 10 standout leather bag manufacturers in Vietnam. You’ll find their specializations and minimum order quantities. We explain what makes each one valuable for different brand strategies.

You’ll discover which partner fits your quality standards. Budget limits matter. So do production timelines. This saves you months of research and expensive sampling errors.

LECAS Leather – Premium Italian Leather Handbag Manufacturer

LECAS Leather runs a full-service OEM operation. They serve handbag brands in markets around the world. Their factory handles custom design through final shipping.

The company gets premium materials from Italy and China. Import records confirm this. Their dual-sourcing approach delivers Italian leather quality at Vietnam’s lower bag production costs. You get European-grade materials. No European pricing.

Custom Design and Production Process

LECAS takes your technical specs through a simple workflow. Send product drawings, detailed instructions, or reference images through their portal. Their team turns your design brief into samples ready for production.

Production starts after you send back a signed pro-forma invoice or purchase order. Email or fax works fine. Most orders ship within 6–8 weeks after confirmation. This covers pattern making, material sourcing, production, and quality checks.

Got larger runs or repeat orders? LECAS sets up custom shipment schedules up front. This helps you manage inventory flow. Seasonal launches become easier to plan.

Pricing Structure and Order Terms

Pricing depends on two things: your order quantity and preferred shipping method. LECAS skips fixed price lists. They quote each product after they review what you need.

They make leather handbags, wallets, belts, and small leather accessories for wholesale buyers. Their B2B setup works well for established brands. You need private-label production with steady quality across multiple orders? This fits.

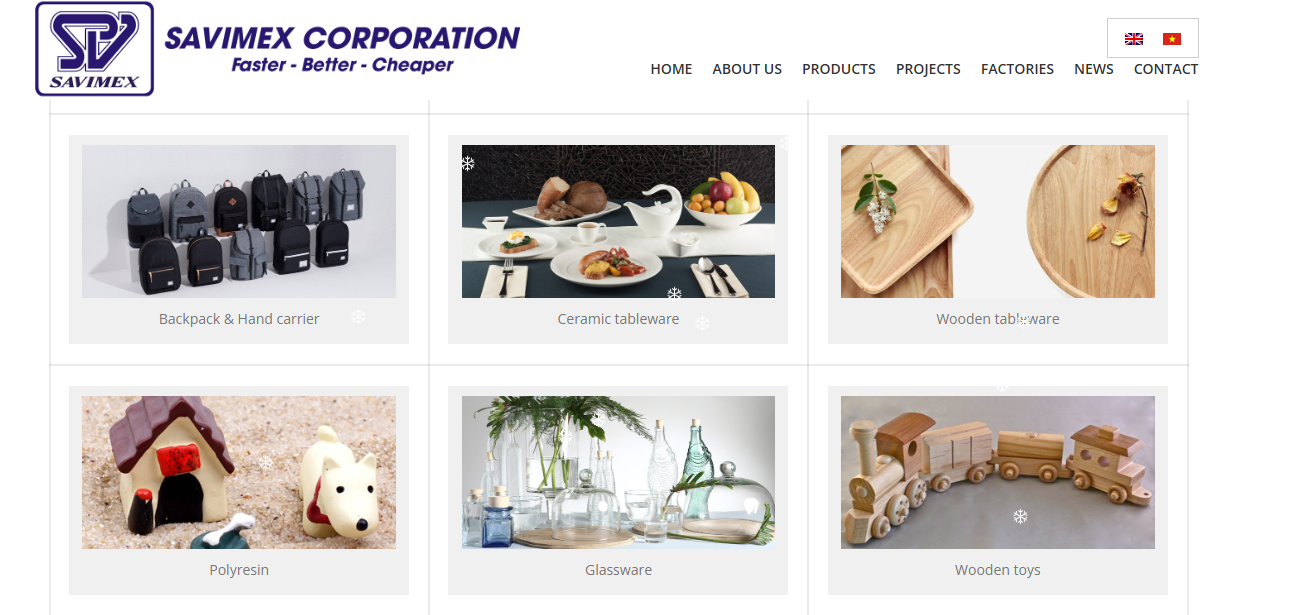

SAVIMEX Corporation – High-End Leather Accessories Specialist

SAVIMEX Corporation started in 1985 as a Vietnam-based export maker. We focus on hotel furniture and household products for the USA, South Korea, UK, Japan, and European markets. We moved into high-quality leather bags and accessories using our craft skills.

Multi-Material Production Lines

We run production lines that work with many materials. Our facilities handle solid woods (Oak, Ash, Walnut, Pine), upholstery, and textile/soft goods making. This lets us make leather accessories that mix materials. Think leather-trimmed travel bags with canvas bodies. Or wooden-handled leather totes.

Our product division makes cosmetic bags, travel bags, shopping bags, shoe bags, and laundry bags. Materials change based on each order. You can ask for full-grain leather, fabric blends, or mixed builds. It depends on your brand needs.

Quality Systems for Luxury Markets

We serve hotel clients across guest rooms, lobbies, and public spaces. These clients are demanding. They need tight standards, consistent finish, and custom specs at scale. Our quality methods work well for leather accessories too.

SAVIMEX put USD 1 million into machinery upgrades at our Ho Chi Minh City plant. This supports export growth. Our production handles mid- to high-volume orders that meet global standards. For specific leather accessory MOQs, contact us directly. Your product complexity affects the numbers.

Atelier Hoi An – Small-Batch Custom Leather Expert

Atelier Hoi An has worked in Vietnam’s leather manufacturing for over 15 years. The factory makes small- to medium-batch custom leather bags for fashion brands and independent designers. Mass production? They skip it. Flexibility is what they do.

This manufacturer works with brands launching capsule collections or testing new product lines. Emerging labels come here for their first production runs in small batches. Market validation done? Brands then scale up to medium-batch reorders with the same patterns and materials. Established brands use them for limited editions and seasonal drops. Volume stays modest.

Production Flow for Custom Bags

Send your tech packs with dimensions, material specs, and construction details. Atelier Hoi An confirms leather type, thickness, hardware grade, and lining options. They make 1–3 development samples first. You check fit, strap length, pocket functionality, and color matching.

Sample approved? Place your small-batch order. Think tens to low hundreds of units per style. Brands moving from artisan in-house work to outsourced small-batch manufacturing find this approach perfect. You keep design control and production flexibility. No need to commit to huge volumes.

Vietnam’s US$3.8 billion leather goods export market backs Atelier Hoi An’s upstream suppliers. Tanneries, hardware suppliers, and zipper makers sit nearby. This setup makes small-batch runs possible for leather bag manufacturers in Vietnam. The costs work out.

TBS Group (Handbags Division) – Luxury Brand Proven Partner

TBS Group runs factories that make products for major global brands in the luxury handbag market. Their lifestyle segment brought in 89.9 billion JPY in net sales during FY 2024. This made it their second-biggest money maker after media and content work.

The company expects 10 billion JPY in sales for 2025. They shared this number even though they usually keep such figures private. Partner talks made them share the data. This shows they have big growth plans for their factories.

Vietnam Production Infrastructure

TBS Group set up special factories in Vietnam’s Song Than 3 Industrial Area. Their TBS Sole Technology Center and R&D Center opened on May 11, 2018. These plants make footwear parts. They also handle leather goods work.

Vietnam is now a key base for TBS work. The country holds USD 73.88 billion of the global handbag market in 2024. This creates strong supplier networks. Premium leather, hardware, and skilled workers are all nearby. Leather bag manufacturers in Vietnam like TBS use this network for luxury items.

Big luxury brands spread their sourcing across Vietnam, Cambodia, Philippines, and India. Companies like Tapestry keep each vendor under 10% of their total stock. TBS Group works well with this approach. Their Vietnam factory meets the tough needs of luxury clients. We’re talking precision stitching, exotic leather work, and quality checks that match European rules.

The handbag market should hit USD 143.2 billion by 2035. This pushes brands to invest in reliable factory partners. TBS Group’s built-up facilities put them in a good spot. Brands growing their Vietnam output need partners like this.

Vietnam Bag Factory – Cost-Effective Leather Solution

Vietnam’s leather and footwear sector generated over US$14 billion in exports during H1 2025 alone. The handbag and luggage segment brought in US$2.2 billion in those same six months, up 11.6% year-over-year. Full-year projections put bag exports well above US$4 billion for 2025. This scale builds strong infrastructure for cost-effective production.

Labor Costs That Change Your Bottom Line

Factory workers in Vietnam’s leather goods plants earn US$181–200 per month on average. The industry employs over 1.5 million people across production lines. This wage level sits well below China and Eastern European alternatives. Labor makes up 30–40% of production expenses. So your per-unit manufacturing costs drop.

Vietnam ranks as the world’s 3rd-largest leather and footwear producer. Factories here output 1.4 billion pairs of shoes yearly and export 1.3 billion pairs as the 2nd-largest global exporter. This manufacturing power transfers to bag production capacity. The same cutting tables, stitching lines, and quality systems work for handbags.

FTA Access Cuts Your Import Duties

Vietnam participates in 16 free trade agreements. These FTAs give your finished leather bags better tariff treatment entering the US, EU, UK, South Korea, and Japan markets. Vietnamese suppliers grew American sales 15.6% to US$8.3 billion in 2024 through competitive pricing. This happened even with historical 10% export taxes on some categories entering the US.

The country imports premium hides from Australia, the US, and Brazil to feed local tanneries. Specialized industrial parks now cluster leather suppliers, hardware vendors, and finishing facilities. This tight chain cuts your lead times and logistics overhead compared to multi-country sourcing setups.

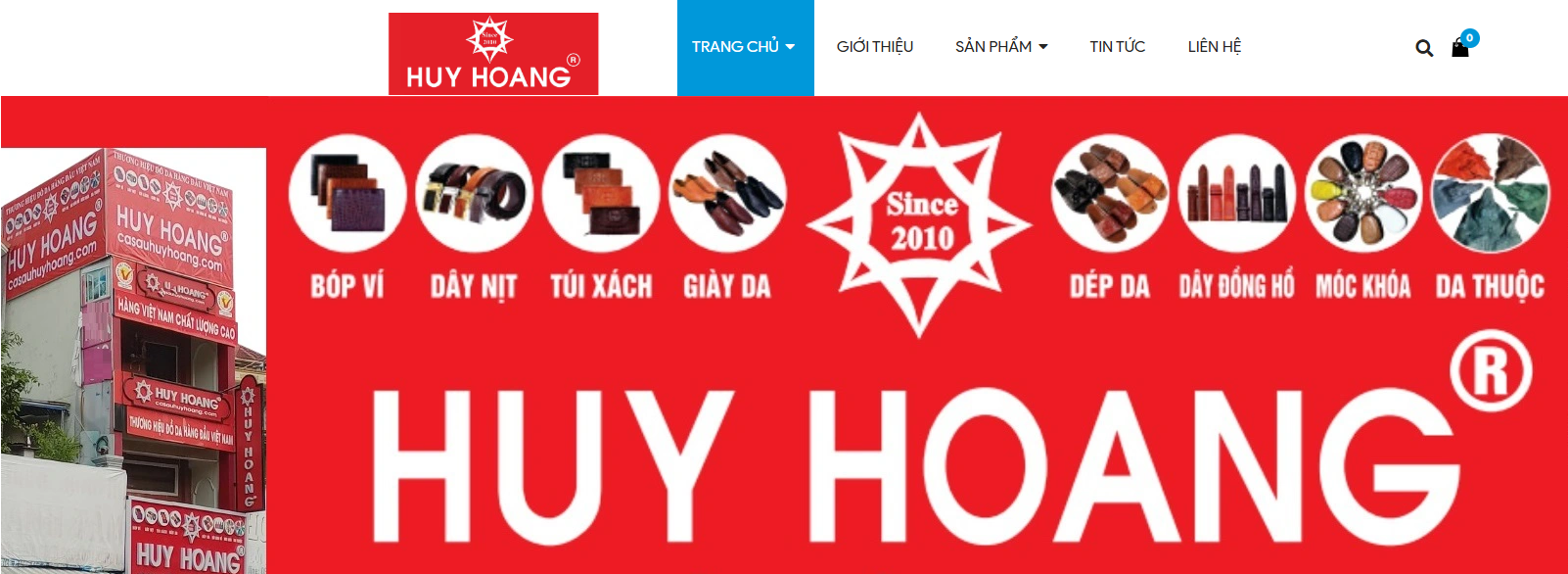

Ca Sau Huy Hoang – Exotic & Standard Leather Specialist

Cá Sấu Huy Hoàng works with both exotic and standard leather. We make high-end finished leather goods and raw leather for export. We’re one of the few leather bag manufacturers in Vietnam certified to handle exotic leather.

Exotic Leather Product Range

Our exotic leather includes crocodile, ostrich, python, and stingray skins. We turn each material into finished accessories. Crocodile leather belts start at 1,499,000₫ for woven-edge styles. Premium crocodile belts with 4P edging were 1,959,000₫. Now they’re 1,179,000₫—a 41% discount.

Wallets come in many styles. Crocodile wallets with woven edges cost 1,299,000₫. You get black, brown, and yellow options. Ostrich leather wallets run 799,000₫ for both the hide from the body and leg sections. Python wallets price at 599,000₫ in natural, black, and brown. Stingray wallets hit 799,000₫.

Standard Leather Accessories

Our cowhide line fits everyday use. Cowhide belts with pin buckles sell for 349,000₫ in black, brown, and white. Cowhide wallets with crocodile embossing cost 349,000₫ too. Three color options available.

Watch straps in real crocodile leather cost 199,000₫ per piece. Colors include black, brown, and yellow. Small brands can test premium materials at this price point. It’s an easy entry into exotic leather.

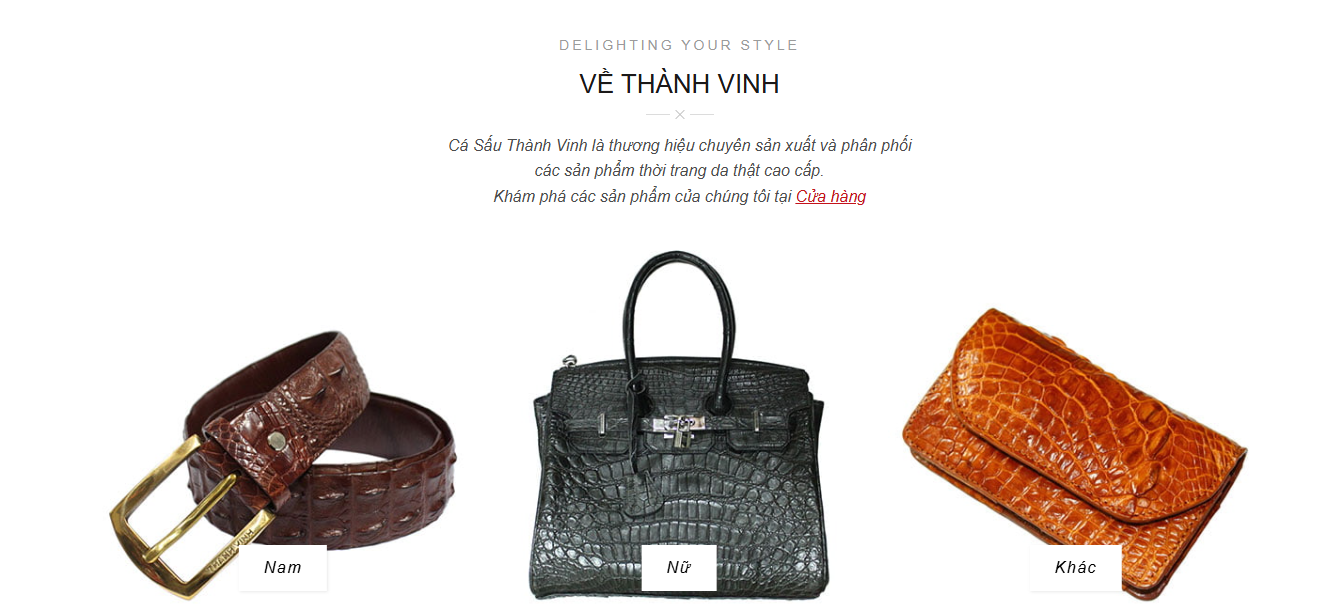

Ca Sau Thanh Vinh – Budget Volume Producer

Ca Sau Thanh Vinh works with brands needing high-volume leather bag production at lower prices. They focus on the mid-market. Order size matters more here than exotic materials or luxury finishes.

Volume-Focused Production Model

The factory runs production lines built for bulk bag orders. Think promotional bags for retail chains. Corporate gift programs. E-commerce brands scaling fast. Their workflow puts consistent output over customization. Standard leather types keep material costs down. Simple construction methods speed up production cycles.

Order 500+ units per style? You get better per-unit rates. The setup delivers reliable schedules and predictable quality. We don’t have specific MOQ or pricing tier details. Contact them with your volume needs and target retail prices.

Cost Structure for Budget Brands

Ca Sau Thanh Vinh serves brands where the leather bag retail price matters most. You won’t find Italian leather imports here. No hand-finished edges either. You get functional leather bags that hit tight price targets. Their buyers? Wholesalers, promotional product companies, and private-label retailers competing on value.

Vietnam’s leather bag makers in the budget segment use local cowhide tanneries. They source from standard hardware suppliers. This keeps input costs low for volume runs.

Xuongda.vn – Full-Service CMT & OEM Provider

Xuongda.vn started in 1997. It was one of Vietnam’s first CMT leather bag manufacturers. The Ho Chi Minh City factory handles cut-make-trim work. It also does full OEM development. Bring your own materials for CMT runs. Or let them source everything—leather, zippers, hardware, linings—for complete packages.

Fast Sampling and Low-Volume Production

Their 30-worker team runs 60 machines for leather goods. Sample development? 3 days from your design to finished prototype. Brands can test new styles fast. No need to commit to big production runs first. The factory sets MOQs at 200 pieces per style. Small and medium brands testing fresh designs can easily meet this.

Xuongda.vn handles cow, crocodile, ostrich, and python leather. They make purses, bags, book cases, and belts from these materials. Need Italian calfskin? Vietnamese buffalo hide? Exotic skins with CITES papers? They source locally or import to match your specs.

Michael Kors is one of their clients. This shows they can meet global fashion label standards. The company focuses on quality and on-time delivery. Brands looking for Vietnam-based exotic leather work with fast turnaround should check out Xuongda.vn’s setup.

Kieu Hung Co., Ltd – CITES Certified Exotic Leather

Kieu Hung Co., Ltd runs its own crocodile farm—Ca Sau Hoa Ca in District 12, Ho Chi Minh City. You can reach the facility in 30 minutes by car from the city center. They control their own crocodile and python leather bag supply. This means they source materials directly for their finished products.

The company makes purses, bags, and belts from exotic skins. They only work with their own designs. Custom production? Not available here. You buy from their existing product catalog. They keep CITES certification across all products this way. No need to handle custom patterns from clients.

CITES Export Compliance System

Kieu Hung ships to Korea, Japan, and the EU. They do not export crocodile products to the USA due to regulatory blocks. Every international shipment needs proper CITES permits. These permits allow legal cross-border movement of exotic leather goods.

The permit application requires product details, commercial invoice, legal origin proof, and recipient information. You’ll need to provide full name, address, and passport number. Processing takes days to weeks. It depends on your destination country. The original certificate must travel with your shipment. Copies won’t work.

Each CITES permit has 14 required fields:

– Permit number

– Issue and expiry dates

– Consignee details

– Permittee information

– Export purpose

– Species common name (e.g., Freshwater Crocodile)

– Scientific name (e.g., Crocodylus siamensis)

– Product description

– Source country

– Quantity

– Official signatures with stamps

This applies to small volumes or personal purchases too. A single crocodile belt needs the same paperwork as a bulk order. USA, EU, UK, Canada, Australia, Japan, China, Thailand, and South Korea all enforce these rules. No exceptions.

Pungkook Saigon II Co., Ltd – Multi-Material Global Scale

Pungkook Saigon II Co., Ltd operates from 2A, Road 8, Song Than 1 Industrial Zone in Binh Duong province. The factory has 100,162 import shipments and 111,378 export shipments in global trade records. That makes them one of Vietnam’s busiest leather bag manufacturers in Vietnam. Plus, they work with materials far beyond just leather.

Multi-Material Production Capabilities

The facility works with many materials at once. They use 100% polyester mesh fabric, printed woven labels, slide fasteners, and various textile fabrics. Trade data shows shipments like 179.16 MTK of polyester mesh at 145 GR/M², 58″ wide. They got 17,564 pieces of printed woven labels from Vietnam’s VI NA Label Trading alone.

Their HSN codes cover nonwovens (5607), coated textile fabrics (5903), slide fasteners (9607), and trunks/bags (4202). This range shows what they do. They handle bag shell materials, hardware parts, and finished bag assembly. All happen in one complex.

Pungkook runs an Adidas accessories factory at the same Binh Duong location. The plant had 1,778 workers in 2022. Athletic brands need bags made from multiple materials. Think gym bags with mesh panels, polyester bodies, and leather trim. This factory setup does just that.

Global Distribution Network

The company ships through Vung Tau port (400 records) and Singapore (75 records). US buyers make up most of their exports. Gymshark USA received 2,899 shipment records. Radial USA logged 2,046, Yeti Coolers had 1,851, and REI shows 18,869 total shipments. These outdoor and athletic brands need mixed-material bags built at scale.

Pungkook links to sister facilities across Indonesia, Ben Tre (Vietnam), and Mexico. Their parent Pungkook Corporation in South Korea processed 334,815 exports and 494,596 imports. This network manages material sourcing by region. It also handles fulfillment distribution. Brands can combine shipments or spread production across multiple Southeast Asian sites.

Conclusion

Of course, Vietnam is not the only option. As global supply chains continue to evolve, Southeast Asia as a whole has become a key manufacturing hub for leather bags and accessories. Countries such as Thailand, Indonesia, Cambodia, and Bangladesh are home to manufacturers with distinct strengths in leather sourcing, craftsmanship, scalability, and cost efficiency. For many brands, these regions deserve a place on the longlist when evaluating long-term production partners.

What truly matters is not the country itself, but how well a factory aligns with your product positioning, material requirements, order volume, and growth stage. Once your target price range, certifications, lead times, and quality expectations are clearly defined, geography becomes just one factor among many.

In our next article, we will shift the focus to Bangladesh leather wallet and small leather goods manufacturers, exploring their advantages in raw leather availability, skilled labor, and high-volume production capabilities. This broader regional perspective will help you build a more resilient and cost-effective leather supply chain.

Stay tuned as we continue mapping out the best manufacturing options across Southeast Asia for your brand’s future growth.